My net worth and monthly expense, or not.

Many personal finance blogs, especially the ones that would like to talk about their path to FIRE or any other personal financial goal, offer a monthly update of the person, or household, expense and sometimes revenues. I have nothing against that and to be honest it’s the kind of post that attract me a lot in the first place into some of these blogs. When I did (and still do from time to time) read these posts, I have a mixed feeling between hope to learn some tricks that I could apply in my situation, willing to compare with others and, I must be honest, a bit of voyeurism. I guess it’s more or less that same reasons that attract most readers to read these posts and why it’s so popular in the first place. When I first dig into it, my first reaction was a feeling of frustration. While the authors were claiming to be fully transparent and willing to share every details with his/her readers, there is never the full picture. Usually you find a list of expenses by category, often a saving rate, but never a clear income figure nor any details. You can of course guess an approximation with the given figures but that’s never really clear what is included or not. Some of these bloggers are really transparent and reveal more or less clearly the income from their blogs, YouTube channel, training program and other related activities but some prefer to hide it, probably to try not to show off or maybe because they think, quite rightly, that it will show to the read that they are really not living in the situation they try to “sell” to them.

Are we spending way above average?

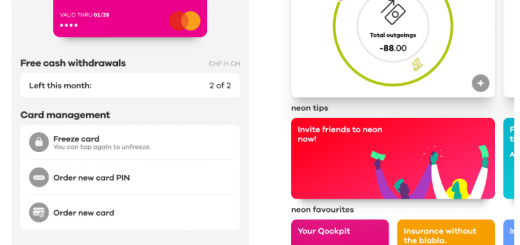

My second reaction after reading several of these posts in various blogs, is that I was not able to save as much as they do, by far. So I start to track more precisely all the expense of the family, going as much in details as I can. After talking about it with my partner, we wanted to spot “where all our money is going”. I was convinced that something was wrong with our finance, how do we end up barely closing some of the months without having to touch at our saving while other couple or families where able to save 30, 40 or even more than 50% of their income. I was getting crazy and I drove my partner crazy as well at some point, by mentioning every little extra we made. “Did we really need this new furniture?”, “Were these new toys really necessary to the happiness of our kids?”, “Should I stop buying any snacks at the vending machine at work?” We already optimize our insurances quite well (we will reduce the annual bill of LAMal by 550frs in 2022, not bad), our telecom bill are many time lower than it use to be, sure we can always get a few dozen here and there but not life changing among, even counted on several years and with compound interest calculated on them with the best investing strategy you can dream of.

Our housing cost had increase with years but we are not living in a fancy house, our apartment as less room than family member and we moved to one of the cheaper area in Switzerland (if we decide to come back to were we come from, the same housing size would cost us almost double for maybe even less comfort). I have also stop eating everyday at the company restaurant as I used to, thanks to my new job and apartment that are at walking distance to each other, I can eat at home most of the week and I even bring my food if I had to eat more than once per week at work.

Finally I find myself spending much less than I used to. When I start working after my studies I was spending quite a lot, while staying reasonable and never, ever, going in debt of course. I always dreamed of learning how to DJ, I got some (second hand, carefully selected) DJ gears. I needed a TV for my new apartment, let’s go for a large (at the time) 55″ screen (that we still us it today, almost a decade later), I want to host my own data, got a home sever (where this blog is hosted). I love video games, especially Nintendo, so let’s buy every new games that look good, get these limited edition Mario, Luigi, Peach, Bowser and Toad controllers (oh there is a Yoshi one as well that I don’t have, let’s check Amazon quickly) and I’m not even talking about all these Amiibo that are now stacked in a box in the basement. Finally traveling was never off the map, of course always in quite cheap hotels, staying reasonable on the expenses on location (beside food, because food is almost always cheaper than in Switzerland, so no restriction on that abroad I was thinking).

These last 2-3 years I had the feeling that I reduce my spending and some of the family spending quite significantly. We even sold a lot of stuff that we didn’t need any more, see my article about it. I also changed my job for one more interesting and with a higher salary, like it should be. But the family situation also changed quite a lot. My partner had to stop working after we go our third kid and of course we got third kids in the first place that come with change in the budget. So the less we spend on personal stuff and long distance travel, the more we had to spend for the kids. Also we now live much more far from our families and most of our friends but still within one day trip reach, so we drive our car much more than expected.

Even so I looked at my spreadsheet (in LibreCalc please, FOSS only) and figure out that we can optimize a few categories. Maybe buy a little less toys or decoration for the house, reduce some family lunch at McDonald’s or Migros Restaurant after groceries, but still it’s not what will bring us to 50% or even 30% of saving rate. So I continued to read these saving rate, expense list, blog posts and start comparing more in details, especially for families in similar situation and I figure out the issue, feeling even stupid once I realize (you are always clever afterwards).

Everybody is different

While I was not always finding all answers I was expecting by reading these kind of posts, I was still able, once I had done our expense tracking myself for some months, to compare us with other families from these bloggers (although the number of such blogger with kids, especially if I limit to families living in Switzerland, is quite low). And the simple truth is that we are all in different situation and it’s very hard to compare to other like that. Now that I had my figures in black and white, I was reassured that we didn’t spend more than a family of four (we are five) that even consider themself as “frugal” somehow, while I’m far from considering us in this term, at least from my point of view. The only reason we are not saving as much as all these successful bloggers out there is that we are earning much less than they do. I was trying to compare us with these persons that are saving much more while they are either single (of course it’s not the same), couple without kids or family with less kids than us having two significant income together. If we consider our income for a family of five, while not qualifying as poor by any mean, we are still in the lower of the range I would say. And if we consider our spending for five, we are in the lower average as well for Switzerland (I checked the official statistics).

Rat race to FIRE

While I was worried that we didn’t made enough effort to save more money and push the whole family to try to watch more our expense, I didn’t see that we were doing as much if not more than what other bloggers advertise to do, with of course some exception here and there but nothing that will reduce our saving rate by two digits. So it would be way too much sacrifices to try to increase our saving to 20% or more. We decided it’s not reasonable so the only remaining solution would be to earn more, much more. What are the options? Hire a nanny to rise our kids instead of us so we can both work 80 to 100%? We didn’t decide to have three kids to leave another person to take care of them. Find a new job that pay much more? I changed my job not so long ago and it was already a hassle to find something interesting that pay as much if not just a little more, I had to refuse several job because the salary was lower that I got previously and I didn’t consider my salary to be that high in the first place (according to my level of education, my experience and by comparing with the Swiss salarium). Get a side job? How to find the time? Again I feel already that I have not enough time, even after I managed to reduce my commute time by more than 2h per day, I would like to have more time with my family and I barely take time to write on the blog or to spend time for myself to watch a movie, play video games or go out with friends (what happened at least once per week if now limited to once per month at best). And the absolute worst, we have close to zero free time to spend together with my partner beside less than a couple hour before bed time after a long day where you can most of the time do absolutely nothing and that is if you are not force to take care about an administrative task or some more housework that we couldn’t finish during the day. I can assume that any side job that will bring significant extra revenue will only leave me (or us) with even less time for what matter.

Is it really what these FIRE advocate bloggers want to sell us? a rat race to FIRE. Where everything you do and live for is to maximize your income and minimize your spending? In the hope to end up free to do whatever you want by your forty or earlier? In between you also hope that you will figure out what you would like to do once early retire. Something that not always turn out well as I could read. But again I’m not judging anyone, everybody is different. I give it a try and figure out that it’s not for me and not what my family need, at least not at the current time, maybe it will evolve differently in the future who knows.

Stop comparing to other, find your own way

As much as it was interesting and attracting in the first place to compare our finance with others that open their books to all internet (or a carefully picked selection of their books), I think this must be taken with some distance and if any comparison must be made, it must take into account the whole picture. My conclusion is that everyone must find his own way, what is best for himself, for his/her significant other and for the family when you have kids. The situation, the needs, what is possible to do or not and what someone is willing to do or not, will certainly evolve with time. There is no secret recipe, no one method fit all. So that’s not only because I care about my privacy and I don’t want to share too much of my personal and family finance with anyone on the internet (it’s a part of it, I’m not ashamed to admit) but also because I truly think that beside the fact that it attracts a lot of reader, it’s not bringing them much at the end. At best the reader can learn a few think here and there but not as much as in a dedicated article. Most of the time, like it was the case for me, the reader will eventually figure out that it’s not comparable to his own situation (most people don’t earn 50% of their income with a blog, a YouTube channel or coaching sessions, even if it’s perfectly find and good for the one that manage to do it). And in worst case it can mislead some reader that are thinking that it can apply to them or to anyone and that they are doing something wrong if they cannot achieve the same level of saving or other kind of goal advertised.

I hope you will understand my point of view and find other kind of articles for you on my blog and if you are really looking for actual figures of someone else personal finance, feel free to search for it as others are happy to share it with more or less transparency. Of course I will continue to write about how to save money in everyday life, how to do investment in diversified ETF at the lowest cost or how to invest in cryptocurrencies. I will show you what worked or worked not for me so you can forge your own opinion and decide what suits you the best.

If you like this post, be sure to subscribe by RSS and follow me on Nostr and Mastodon to not miss any future post.