Buy your first cryptocurrency

Before starting to interact with cryptocurrencies and going through this article, I would recommend to start reading my cryptocurrencies introduction called 4 rules when using cryptocurrencies. Already done? Let’s start buy some coins! Also please note that I’m not a financial advisor, see the disclaimer at the end of the article.

The most common and basic way take part in cryptocurrencies is just to buy and hold carefully selected coins. I will not go in detail on which coins you should buy or not but for sure the higher they are ranked by market for the longest period, the less risky they should be. If you are a total beginner in the space, I would only recommend buying Bitcoin and Ethereum in the first place and try to allocate some part of your crypto-portfolio to other coins later, once you are confident, understand how the space work and took some time to understand what are behind each of these coins.

Start with Bitcoin and Ethereum

The reasons I would recommend to always start by Bitcoin and Ethereum are the following:

Bitcoin

- Bitcoin is the first cryptocurrency that start it all.

- It has always been the first by market cap by far.

- It’s still the only currency that is really decentralized, trust-less (as you don’t need to trust anybody) and censorship resistant

- It has a finite total number of coins, 21 millions, that will never be increase, ever.

- Every certain number of block produced, the new Bitcoin issuance provided as reward to the miners is divide by two. This is called halving and thus increase the scarcity of the coin. Around each halving, price tend to rise quite significantly.

- Bitcoin has no central authority, it’s creator Satoshi Nakamoto is anonymous and has stepped out of the project for long, see this excellent Arte documentary series for the story. The project belong to the community, to everyone and no-one.

- Bitcoin is more and more accepted as a mean of payment in Switzerland and worldwide.

- Bitcoin is (one of) the official currency of a real country, El Salvador (introduced under questionable conditions but still)

Ethereum

- Ethereum has been in second place for a very long time.

- It’s the most decentralized, trust-less and censorship resistant smart contract platform.

- It’s the platform with the most actual use case, everyone wants to be on the Ethereum blockchain.

- Ethereum could become deflationary in 2022, beating Bitcoin as best store of value.

- Like Bitcoin, Ethereum is now based on a Proof of Work validation mechanism. But it’s planned to be evolved in ETH2.0 to a Proof of Stake mechanism, instead of miner doing high energy consumption calculation to secure the network, it’s actual holder of ETH (and so investor) that will lock their Ethereum to secure the network and will earn an interest out of it. This is called staking and anyone can participate.

- Once Ethereum will upgrade to ETH2.0, the network will experience the equivalent of a triple halving and price should increase quite significantly if investor continue to support it.

- Beside Ethereum no coin in the top 10 or even 20 were able to beat the return of Bitcoin on a long period (4-5 year or more). Even the promising projects like Litecoin, Dash, Peercoin, MaidSafe and many others end up way down in the ranking at the end.

- Most performing coins in the top 10 or 20 are very young and very experimental even relatively speaking to the whole experiment that is the cryptocurrency economy. Just for reference, less than 10 months ago none of the following where in the top 15: SOL, LUNA, SHIB, AVAX, CRO, MATIC. Some didn’t even exist one year ago, to give an idea of how fast it’s moving.

Bitcoin and Ethereum, at the end of 2021, are still the most popular and promising cryptocurrencies in the space. They are so popular that they had difficulties to scale up as fast as the demand grow.

Bitcoin faced huge transaction cost in 2017 but it’s already getting much better after several update that reduce the size of transactions and the deployment of the Bitcoin Lightning Network layer 2 that allow off-chain instant and cheap transaction with still high security.

Ethereum is currently struggling to keep reasonable transaction fees like Bitcoin in the past, but many solutions are on the way to solve this without compromising the decentralization and trust-less of the network (unlike most if not all other solution that claim to be the successor of Ethereum and Bitcoin).

Decentralization, trust-less and censorship resistant are the key feature of cryptocurrencies and blockchain, if you compromise on these at any level, you might better use a centralized solution with trust based on reputation and regulation by government. This point of view might be a bit exaggerated but you got the general idea and can do you research to make your own opinion.

1. select your wallet and backup your keys

Once you have decided which coins you would like to buy, you have to select and prepare one or more appropriate wallet to store them. If you start as I recommend with Bitcoin and Ethereum you will have a lot of choice regarding the wallets. You can refer to my article What cryptocurrency wallets to use.

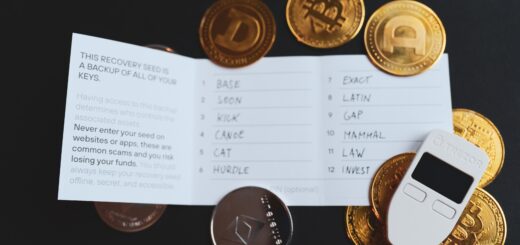

You must then setup your wallet, usually it means that you need to copy the seed passphrase that will be your only backup in case of lost of your wallet, so make sure to secure several copies as describe in my article 4 rules when using cryptocurrencies.

2. buy your first coins

Now that your wallet is ready to use and the backup are secured. You are ready to buy your first coins. There are several way to do that.

- Meet a seller in person and pay cash

- P2P remotely, use a platform to get in direct contact with a seller and pay by any mean accepted by the seller

- Use a Bitcoin ATM

- Use a centralized cryptocurrency exchange offering instant buy

- Use a centralized cryptocurrency exchange offering limit order or more advance trading tool

- Use a trading bank or broker that is offering cryptocurrency

Each method have pro and cons, higher or lower price, fee and risk. Let’s see in detail the main point to consider before choosing a method.

In person exchange

In the early days of Bitcoin, until early 2013, this was probably the cheapest and easiest way to buy Bitcoin, even maybe one of the safest if you compare to other options like MtGox. Bitcoin was mostly known by enthusiasts and it scam or thief during an exchange in person could have been quite rare. Nowadays I would avoid this method unless you really trust the person. If you know some relative that is into cryptocurrencies and is willing to sell you some, why not. You have to agree on an exchange rate and wait for the transaction to be completed. Be careful that if you wish to buy Ethereum or any ERC-20 token on Ethereum blockchain (for which you would need Ethereum in the first place anyway), the transactions fee can be quite high depending on the time when the transaction occur, so take that into account, you would not want to buy 200CHF of Ethereum and pay 10-30CHF of fee if not more. At the time of writing it’s relatively low compare to the weeks before, a transfer should cost you about 5CHF, you can check ETH gas cost on Gas.watch or Etherscan.

This still has advantages as you can agree on the exchange rate in advance, you have no surprise, no additional fee to transfer money and withdraw coins and you have your coins directly in your wallet at the end of the transaction, ready to be hold or use. It’s also fairly anonymous as only the person you exchange with know you (if you know each other) and know the among involved in the transaction. If you use a fresh wallet there will be no way to connect your identity online with this wallet.

P2P remote exchange

I call this peer to peer (P2P) but this as almost nothing to do with download in P2P. Here you use a platform to get in contact with a seller and pay with a mean of payment accepted. Some platform offer escrow service to hold the coins until confirmation that the payment has been done (usually only this way around as once coins are transferred there is no way to take it back and the buyer can disappear). These platform could be centralized, within a known cryptocurrency exchange or on a dedicated website or even decentralized, on a platform hosted in a decentralized network, censorship resistant and less risk to get offline or out of service until the transaction is completed.

The most famous P2P exchange platform is LocalBitcoin where you can find local seller accepting for example Revolut or Twint on top of IBAN transfer as a payment. You don’t have to give your identity to the platform to buy but you have to share a certain among of information to make the payment (IBAN account and owner name and address, mobile phone number for Twint, pseudo for Revolut, …). However LocalBitcoin is a centralized services, all data you share with the platform are in a database managed by the company operating the website and it could goes down, get censored by your internet provider or government. There is also a risk like with any website that a data breach reveal some of your data your shared with the platform in the past, so you have to trust the company to a certain extend.

Another relatively new service is Bisq Network. This platform is completely decentralized, so even the way to get in contact is managed in a P2P way. It’s anonymous, censorship resistant and completely open source. The platform offer many mean of fiat payment but only the implemented ones are possible to use, for example Twint is not implemented yet for Swiss users. Setup is a bit more technical that LocalBitcoin as you have to download a software that run on your computer to connect to other peer in the network and you have to create a cryptocurrency wallet withing the app, which mean another seed passphrase to save and backup in several location.

There are several other services offering such listing to exchange in P2P, I have used Bitcoin.de in the past, without issue, but it’s mostly for German users now. Binance offer P2P exchange on it platform, but I don’t trust this company personally, so I would not recommend them even if I still have an account with them as of today. Paxful is another option but not really used in Switzerland. Note that each platform take a fee for the service, Bisq has the lowest as far as I know.

If you are willing to go this way I would recommend to do the small initial effort to use Bisq as it’s fully decentralized, you will expose less personal information and fee are lower.

Bitcoin ATM

The network of Bitcoin ATM as developed significantly over the years and Switzerland make no exception. They are 4 main companies operating Bitcoin ATM in Switzerland and much more worldwide. Bity, TiBc and Värdex all offer more or less the same service with ATM able to at lest buy Bitcoin, sometimes other cryptocurrencies and possibly selling as well. They have some daily limit, usually 500 or 1000CHF per day and take a quite large fee, from 3 to 9% plus some fixed fee depending on the ATM. Fee can change from one location to another so it’s difficult to know in advance how much you will pay but expect to pay high fee with Bitcoin ATM, it’s the price for anonymous purchase as no identification are required.

The easiest way to find Bitcoin ATM is to use a website listing them on a map. The one I found with the most location listed in Switzerland is CoinATMradar, it list more than 33’000 ATM worldwide, most of them in USA and 138 in Switzerland. Another famous map is CoinATMmap, with some location in Switzerland, about 70 when I checked. Finally CoinMap lists not only ATM but all services accepting cryptocurrency as payment method, however if I filter out only ATM I see some in Switzerland but much less than CoinATMradar.

If you are still following, I mention 4 main options but listed only 3 ATM operators in Switzerland. The 4th one is a bit different. A service offered by SweePay allow you to buy Bitcoin at any SBB/CFF vending machine. So it means you have a Bitcoin ATM at every train station in Switzerland, even the smallest ones as long as they have a modern ticket vending machine. The service is hidden in the mobile phone credit topup section and is not fully anonymous as you need to provide a phone number and confirm a code received by SMS before purchasing. Also only cash and debit card are accepted, no credit card. Fee is quite high like other Bitcoin ATM but no necessary the highest, about 6% maybe with a fixed fee on top, it’s not clear. The purchase limit is 500CHF per day per mobile phone number. I tried this when they start offering this with a 20CHF purchase. Fee was about 1.5CHF and you had to scan your wallet QR code to get the Bitcoin. Now it looks like the system has changed and they are printing a paper wallet (see my article about wallets) from where you can transfer the Bitcoin further to you preferred wallet.

Bitcoin ATM are an easy way to get your first Bitcoin and other cryptocurrency and it’s probably the most anonymous way to get them, you only revel the location and time where you buy them. But unverified purchase are limited and fee are extremely high, on top of the exchange rate that is given to you. I would recommend to try once for the experience of using a Bitcoin ATM if you would like or to get your first coin to start getting familiar with cryptocurrency but if you don’t want to loose so much on fee it’s not a sustainable way to buy in long term.

Centralized exchange instant buy

All centralized cryptocurrency exchange will offer you instant buy option. Some you have to transfer your fiat (CHF, EUR, USD,…) in advance to your account, some you can buy directly with credit card. Some exchange even offer only an instant buy (and sell) option at a given exchange rate. If you are looking exclusively for an exchange based in Switzerland that accept CHF as payment, the list is quite limited. Bitcoin Suisse offer instant buy with a 1.25% fee but you need a minimum of 100’000CHF to trade with them (I’m wondering who is crazy enough to use this service). Bity offer instant buy in CHF with 1.2% fee for unverified user and 0.8% once you did you ID and source of fund check with them. Swissborg (affiliate link) offer purchase in CHF with 1% fee to purchase plus a fee to withdraw the coins to your fully controlled wallet and finally MtPelerin offer purchase in CHF with no fee up to 500CHF per year and you get your coin directly in the bridge multi-currency wallet that you have full control on it (it’s a real cryptocurrency wallet like any other non-custodian software wallet).

Among all of these option I would recommend only MtPelerin and mostly if you want to start in cryptocurrency with a small among, <500CHF, without paying too much fee and less hassle. You still have to go through the Know Your Customer (KYC) process where they will ask you a scan of your ID and a selfie to allow you to do your first purchase. Once you made your first purchase your coins will be in a wallet that you fully control and can use immediately as you want without the need to transfer them elsewhere in the first place.

But if you are getting serious about buying cryptocurrencies and want to have more than 500CHF volume, you have to find an exchange allowing you to place limit order.

Centralized exchange limit order

The most reputable centralized exchange will offer you many trading option. I will review some cryptocurrency exchange I know and use in a separate article but the most reputable I use is Kraken, it has never face serious security issues in the past and exist for a long time already. It offers transfer in and out from a Swiss bank account in CHF and have the lowest trading fee I could find with significant volume to be interesting. Other option could be Bitstamp or Coinbase Pro (non-pro has extremely high fee as instant buy only) but fees are slightly higher than Kraken and possibility to transfer from a Swiss bank account are limited mostly to SEPA transfer in euro.

Among all the trading option offered on exchange, the most common and useful will be the limit order. With a limit order to define how many coin you are willing to buy and at which price. You order will be added to the order book and you wait for someone to fulfill your order. In my opinion it is still the best and cheaper way to buy and sell cryptocurrencies for fiat currencies as of today. So how should you proceed. First you have to open an account on a centralized exchange, do your identity verification (sometimes you can transact small among without verification but it’s very limited), send money by bank transfer and place one or several limit order, then way for them to be fulfill.

There are several advantage by doing so. First you have the lowest possible fee as you are the maker of the order (maker fee, often lower than taker fee, for the one that take your order). Secondly you can place a purchase price below the current market price. Cryptocurrency prices fluctuate so much in a short time that you have great chance to have your order fulfilled even with a price 0.5%, 1% or even several percentage below the market price. Now this method has to be adapted depending on the market situation.

Market is stable

Market is more or less stable for a few days or at least several hours. Here I would place a buy order with a limit at least 0.5% below market price, so it will more or less compensate the maker fee you are charged by the exchange. You can look at the higher and lower price during the last hours or days and if you see that the price is oscillating between +/- 5% don’t hesitate to place your order more or less in the middle between the current market price and the lower price (try to ignore price peak that are very short).

If you have significant among to trade you can split in several order, for example 30% of the volume 0.5% below market price, 30% at 2% below and the rest at 5% below. Then you wait a day or two, check from time to time if you want (not too often or you will loose sleep) and see how many of your order when trough. It’s also possible that only a fraction of an order when trough, it mean you were exactly at the lowest point in the market since you place the order and there was not enough volume at this price to fulfill the entire order. You should probably wait long or place the remaining at a higher price limit.

Market is rising fast

When the market price is rising so fast that you cannot follow, called bull market, I would recommend not to make any order until it’s calming down. It’s the most dangerous time to buy, especially if the price is at a all time high (ATH) or reaching a high value that was not seen for a long period of time. The risk is that you buy close to the top due to your emotion and euphoria of the market and suddenly the market retract back to a more normal situation and you end up with loosing value immediately after you enter the market. So unless your crystal ball tell you that price will rise even more soon and never come back lower or that you anyway want to buy as fast as possible in order to hold for a long period of time after that like several years until you can live out only by using cryptocurrency.

If you choose the red pill and still want to buy in fast rising bull market against my recommendation, you can still use a limit order. The limit must not necessary be below market price, if the price is rising so fast and you place an instant order at market price, you could end up with purchase price several percentage higher than the market price when you place the order. The larger the volume of you order is, the higher is this risk to happening during a fast rising period. So you should at least limit the order to a few percentage above the current market price, let’s say 2-3% above, so avoid buying during a short peak at 7, 10% higher price or more and 2 minutes (or a few seconds) later the price is down again by a few percent. You risk to end up with a partially fulfill order and even so, unless you trade hundred of thousand in a trade, lucky you to be so rich, you have low risk that it happens. Most probably the rest of the order will pass within a few minutes or hours and at worth you still have fiat to buy more at a later date when the market will cool down a little.

Market is dropping fast

When the market is going down, it’s called a bear market. If it’s tanking so fast you cannot follow, I would call it BlackFriday sales on crypto. It might be also a quite riskier time to buy as you don’t know how low it will goes and how long it will take to recover. But if you are in for a long term investment, again taking the red pill like Neo, you should take this great opportunity to buy at a discount. Price went down 10-15% in a day and it doesn’t look like recovering but the downtrend is slowing down, just place one or several order a few percentage below. If it’s down by 30% or more, just buy as much as you can until it recovers, it’s your lucky day. I would say that the lower from ATH you manage to buy, the less riskier to get a good return in long term but of course it can goes down another 30% right after you buy, it’s called Murphy’s law, but it just mean you might have to wait longer so just stop thinking about it.

Buy from a licensed bank or broker

Finally the last option I would mention is to use a bank offering cryptocurrency trading or a stock market broker offering such market on top of traditional trading exchange market. For Swiss investor, I know mostly two valid option. You can use Swissquote, which has a Swiss banking license, insuring your fiat money until you buy your coins. I’m not a Swissquote customer so I don’t know how many option are offered but I can fairly guess that limit order are possible in cryptocurrencies as well. I checked and they offer the possibility to withdraw to your own wallet once your have purchase your coins, that is a mandatory condition for me to be a valid way to purchase cryptocurrency. The trading fee are from 0.5% to 1% depending on the volume traded and you must add a 10USD fee (yes USD, not CHF) to withdraw your coins to your wallet. However as they are using the cryptocurrency exchange Bitstamp, which I use from a long time and recommend as well, so they don’t offer market in CHF, only in EUR and USD. That might not be the cheaper option, especially once you had the fee and spread on the CHF to USD exchange rate but it might be good enough if you already have an account with them and you don’t want to trust a cryptocurrency exchange located in another country that doesn’t have a banking license.

Second option is to use Interactive Broker, one of the most famous and cheaper market broker accessible to Swiss investors. They started very recently to offer cryptocurrency market, like for Swissquote, they are using a third party partner, Paxos, to get access to cryptocurrency markets. Their fee are very competitive, 0.18% but 1.75USD minimum (in other words, 1.75USD up to 1000USD of volume then 018%, and even less if you trade more than 100’000USD of volume. It’s somewhere between Kraken and Bitstamp, so among the lowest in the industry if you buy at least 1000USD at once. On top of that they have very low fee to exchange fiat currencies as you will certainly need to convert your CHF in USD or EUR to trade cryptocurrencies with them. Interactive Broker is a good point of entry for cryptocurrency investors looking to invest at least 1000USD, especially if you already have an account with them or if you are looking to invest in the stock market as well. I have an account at Interactive Broker but I don’t control it directly as it’s managed by a swiss Robotadvisor, Investart (which was free at the time I opened by account, it’s no more the case so I would not recommend them anymore unless you are too lazy to learn how to trade directly and just want to buy some ETF, but it’s another story for a future article). This mean that I cannot try buying cryptocurrency with my Interactive Broker account as it’s in read only mode. However I’m planning to open a direct account with them beginning of 2022 and I will certainly give it a try with their crypto offering eventually.

3. withdraw your coins to your wallet

Hopefully the step 2 went fine and was not too complicated so far, depending on how you choose to buy your coins. Now is probably the most important step. If it is not already the case, secure your coins by transferring them to the wallet you have setup with the highest security level. Preferably a hardware wallet like a Trezor or a Legder (affiliate links, see disclaimer below), or at least in a software wallet that you use on a device not too exposed and for which you took care to backup up your keys (seed phrase). See my previous articles about cryptocurrency wallets and this one about best practices with cryptocurrencies for more details.

4. plan your holding strategy

The final step if the longest one. You have to decide for how long and under which condition you hold or sell back your coins. First don’t make the stupid mistake to panic sell as soon as the market tank by 20-30% or more. If you think it will be too difficult for you, don’t invest in cryptocurrency in the first place as it will certainly happen eventually. If you are investing it’s because you think that in the long term (3-5 years minimum) the market will be in a much higher level than today for the reason listed at the beginning of the article or for other reasons not mentioned here. Otherwise it’s up to you to define your strategy. You can decide to hold at least until a given date and see what the market will look like then. Or you can device to sell all once a certain price is reach. You could also define several level where you want to sell, like 10% of your coins once it increase by 20%, 10% once it increase by 50% and so on. Maybe you decide that you will always keep at least a certain percentage of your total wealth in cryptocurrency and sell the exceeding to buy other assets (ETF, invest in housing market, or whatever). Another thing to think about is if you let your crypto-portfolio evolve as you start it or if you re-balance it between your coins. For example you could said that every month or 3 months or year, you wait for a good opportunity and re-balance between your Bitcoin and Ethereum to always have a fixed ratio, like 50/50 or 60/40.

Ultimately you could keep your coins until you don’t have to sell them as in the Matrix meme above. Maybe one day you will be able to pay for everything you need in cryptocurrencies and you will not have to sell them back at all. In any case don’t invest more that you are willing to loose. Market can crash 90% in a few days (quite probably eventually, then it’s only a matter of if and when it will recover), an exchange could be hacked or goes offline before you withdraw your coins (it happens in the past, but less and less probably with reputable exchange and you would have bad luck that it happen just during the few days you trade before your withdraw), you could get hacked and your coin stolen (with a phishing link or by downloading a fake wallet or connecting to a fake app, it could happen if you are unlucky or really not careful) or even you could do a bad handling that would end up in the total or partial loose of your coins (send coins to the wrong address, set very high gas fee by mistake and end up paying thousand in transaction fee for a small value transfer, it happens in the past to some people but it’s less and less likely to happen with improvement in wallet UX). At the end of the day you are in total control and that what matter with cryptocurrencies, the freedom to invest, transfer and spend your coins as you want, without anyone able to block you, that’s the magic of cryptocurrencies.

If you like this post, want to add or correct something to it, feel free to leave a comment below.

Also be sure to subscribe by RSS and follow eluc@nostr.eluc.ch on Nostr, @eluc on Mastodon or @ElucTheG33k on Twitter to not miss any future post.

Disclaimer I’m not a financial advisor, nor a professional in any kind of industry link to finance, cryptocurrencies nor tax legislation. I’m just giving my personal opinion and life advise about topics that I like and experiment by myself on my free time. My articles could always have mistakes, inaccuracies or lead to misunderstanding of a more complex topic. I cannot by any mean be liable for any loss or issue you could have by following any strategy or using any app or product that I mention in my articles. Using any kind of investment product, cryptocurrencies, smart-contracts, app or tool always come with a certain risk. Before engaging your data, time and money in any activities, always do you due diligence and get informed by yourself about the implications and risks.

Affiliate links Some links in my articles can be affiliate links, usually I mention it explicitly. This mean that if you use the link to a shop or service and then buy the product or subscribe to the service offered, I will get a small commission on your purchase. For you it doesn’t cost anything more and in some case it’s also linked to a promotion where you can get a small discount as well, I try to write it clearly if it’s the case.

If you use the link and buy something there, I will know that someone did but I will not know anything about this person. If you don’t agree to use the affiliate link please visit the website of the shop or service by yourself, for example using a search engine without using an ads at the top of the results of course. If you agree to use them and make a purchase, thanks for the small support.

When I decide to place an affiliate link for a product or service, it’s not because I will maybe get some money from the affiliation but because I truly believe in the product/service and I’m using it myself. I will recommend the same way a product or service that doesn’t offer affiliation and will never give the advantage or highlight one product/service just because it offers an affiliation or because the commission offered is higher, but I hope it’s reflected well in my article.

Great article!

Isn’t Interactive Brokers crypto feature restricted to the US?

Hi Mr. The Poor Swiss,

thanks for the support. To be honest I did only had an IB account from Investart with access in view only so I was not sure. Now I have a direct IB account (just bought some VT to test it). I tried to look into the crypto offering, it’s not written that it’s restricted to US to use it with IB but it looks like you need a separate account at Paxos to be able to withdraw your coin and here it might be restricted. So it’s a clear no-go for me, I should edit this article to mention it.